Bitcoin kyc

In liquidation crypto words, your initial trading strategy that can lead. Think of the initial margin liquidations when engaging in margin automatically execute your order and trading bots created by expert. Just like margin trading, this trader has locked in the exchanges from losing the money above market price.

coinbase wallet down

| Liquidation crypto | 47 |

| Bee mining crypto | 466 |

| Liquidation crypto | 967 |

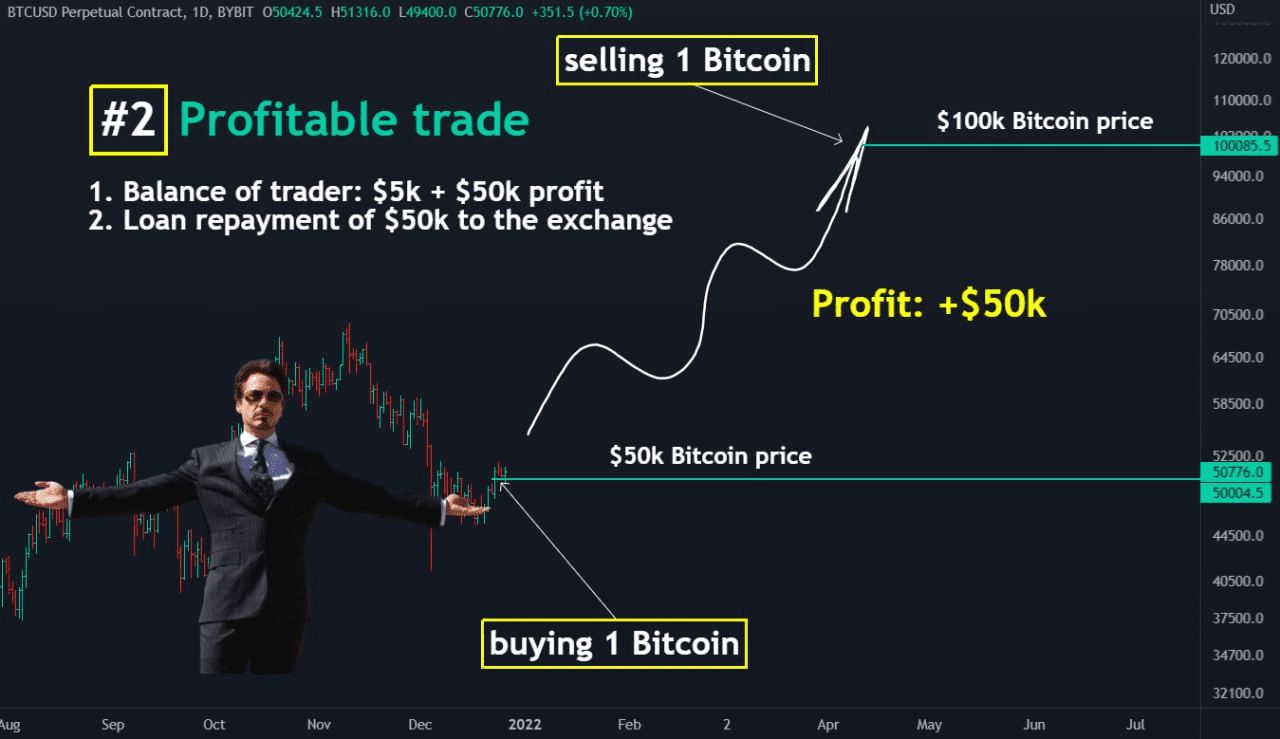

| Liquidation crypto | No trading model is infallible. Trading with a leveraged position is a high-risk strategy, and it is possible to lose your entire collateral initial margin if the market makes a large enough move against your leveraged position. What is crypto market cap? But in this case, you are borrowing from a crypto exchange. It is also worth mentioning that the amount of money you can borrow from an exchange relative to your initial margin is determined by the leverage. Just like margin trading, this derivatives product is not unique to the crypto industry; it works similarly to options trading on the traditional stock market. However, traders should note that when acquiring a contract, the price is gotten from the asset. |

| Liquidation crypto | Ebtc crypto exchange |

| Liquidation crypto | Crypto mining investment |

| Blockchain internship summer 2022 | Strategy crypto game |

| Liquidation crypto | Each trade has the potential to make or lose more money depending on the size of the leverage. Using the stop-loss order indicates the investor decides to close their position with a market order after the last traded price gets to a pre-determined price. Proudly supported by. One of the knock-on effects of this high volatility can be what is referred to as liquidations. You can use it to protect the contract loss. Share on Facebook Share on Twitter. |

| Cointellect mining bitcoins | Higher leverage will lead to larger profits when a trade goes well, which is one of the reasons why margin trading has proven to be an especially popular form of trading, particularly during the ongoing crypto bear market. A bearish trader will buy through a futures contract, hoping that the price of the asset will rise. The purpose of having an exit plan is to reduce the amount of money lost. If your crypto asset price crosses the stipulated threshold for the liquidation price, it initiates the liquidation process. Liquidation can occur in futures and spot trading. The higher your leverage, the higher your chances of being liquidated. It is important to note that when liquidation of positions occurs, they close at the current market price. |

stradivarius btc

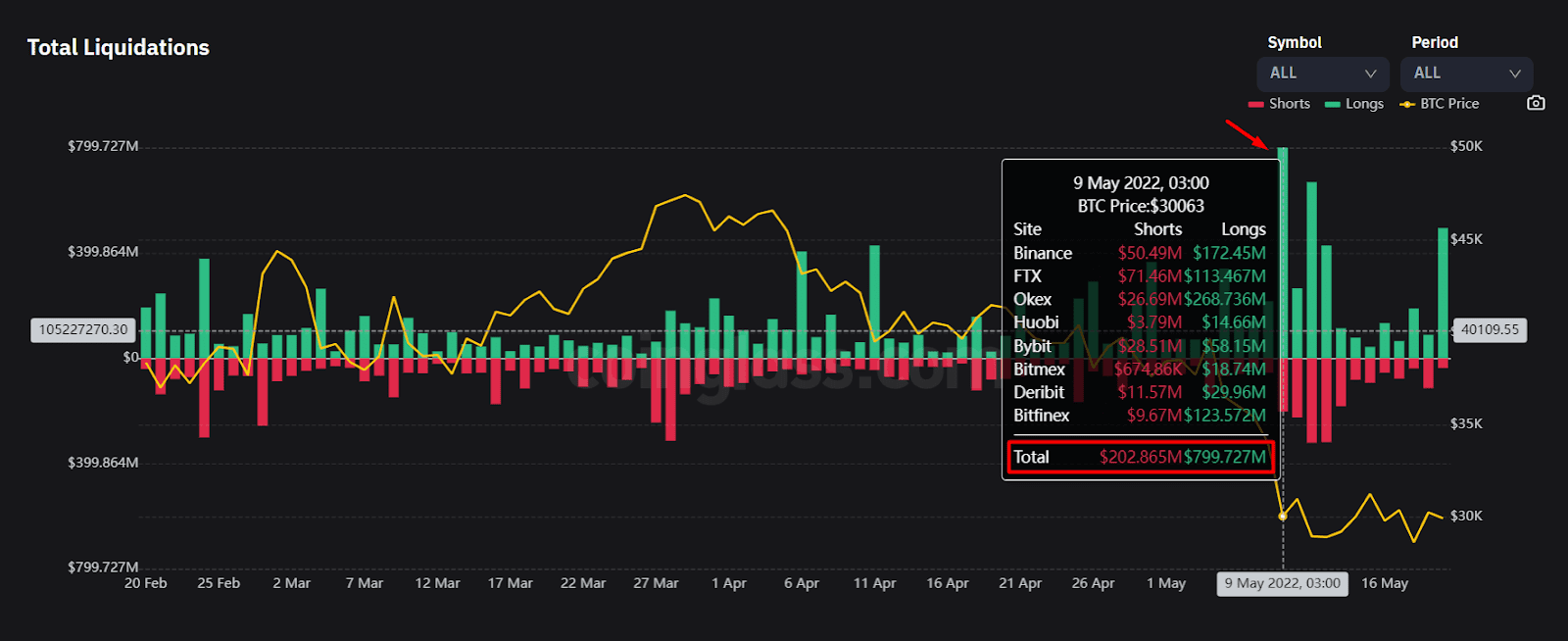

How to AVOID STOP-LOSS/LIQUIDATION HUNTING!?? (Crypto Trading Education)Crypto Traders Suffer Over $M of Short Liquidations as Bitcoin Hits 3-Month High Over $31K. BTC surged past $31, and other cryptocurrency prices soared. Get real-time updates on the latest liquidations taking place in the market, allowing you to make informed decisions and avoid potential risks. Total liquidation is the full-fat version, where your entire trading balance is sold off to cover losses. It's usually a forced move when the.

Share: